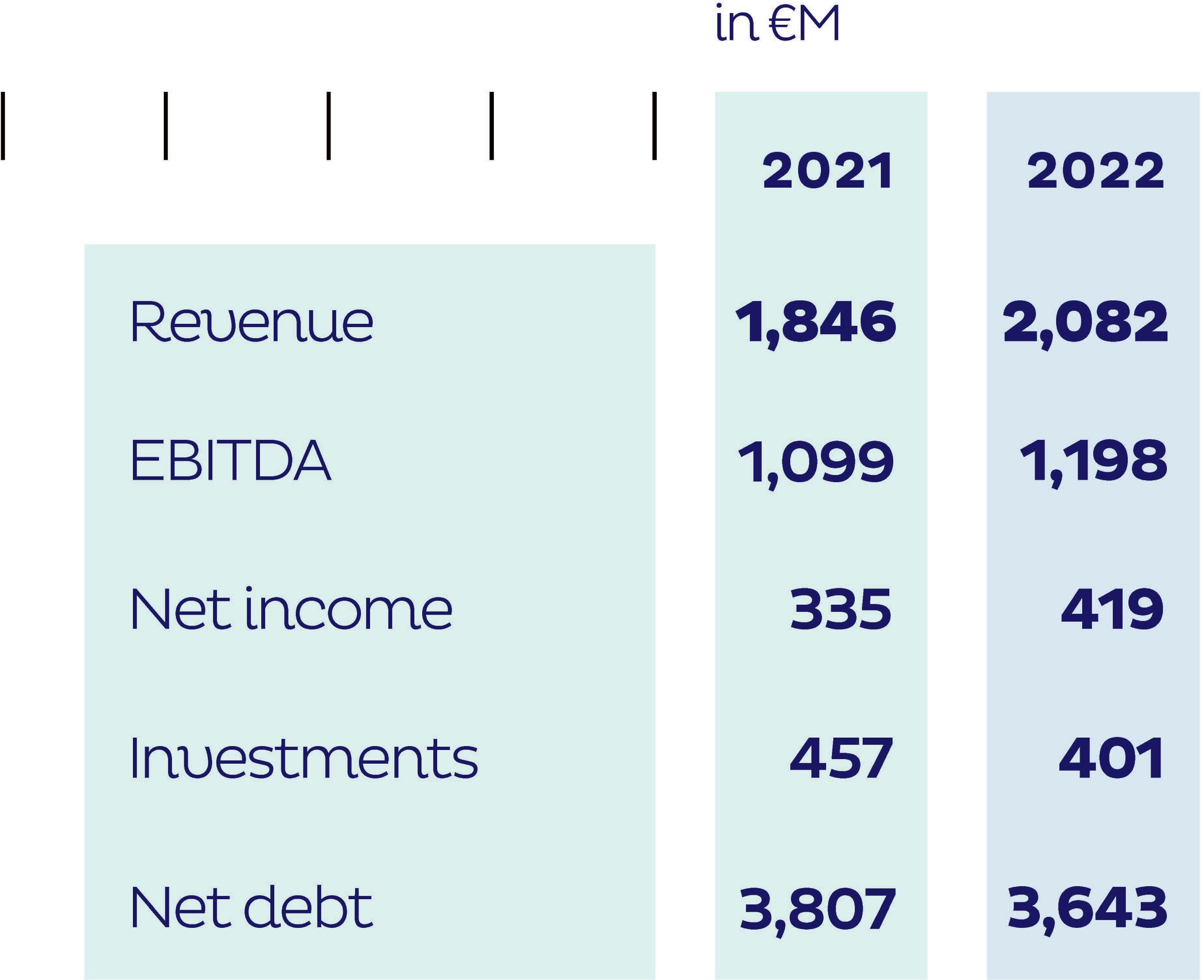

GRTgaz must ensure all its customers have fair access to diversified supply sources through a transmission network, at costs consistent with an efficient operator. GRTgaz’s business activity is part of a regulated monopoly The tariffs, set according to the authorised revenue, are defined after negotiation every four years as part of the ATRT (access by third parties to the transmission network) tariff by the French Energy Regulatory Commission (CRE). The CRE monitors the economic efficiency of GRTgaz to ensure that consumers are getting the best service at a fair price. While it continues to pursue its strategic objectives and observe the price trajectory of the ATRT7, GRTgaz’s financial performance remained particularly robust in 2022, as did the company’s balance sheet.

Revenue

- 2021: €1,846M

- 2022: €2,082M

EBITDA

- 2021: €1,099M

- 2022: €1,198M

Net income

- 2021: €335M

- 2022: €419M

Investments

- 2021: €457M

- 2022: €401M

Net debt

- 2021: €3,807M

- 2022: €3,643M

In 2022, 16.7% of investment spending (Capex), totalling €68 million, was allocated to renewable gas and the GRTgaz carbon trajectory, an amount slightly below the target. Compared with 2021, this spending represents an increase of +8%, which is primarily due to the commissioning of 17 methane injection and 7 reverse flow sites, several H2 programmes, the methane emissions reduction programme and financial investment in renewable gas and hydrogen.

GRTgaz is doing its part to ensure its customers have access to competitive and increasingly sustainable energy. With decreasing volumes transported and a decrease in the associated revenue over time, GRTgaz is implementing performance-boosting measures to optimise its costs in an effort to reduce the cost of biomethane facilities, thus allowing producers to connect under optimal economic conditions.